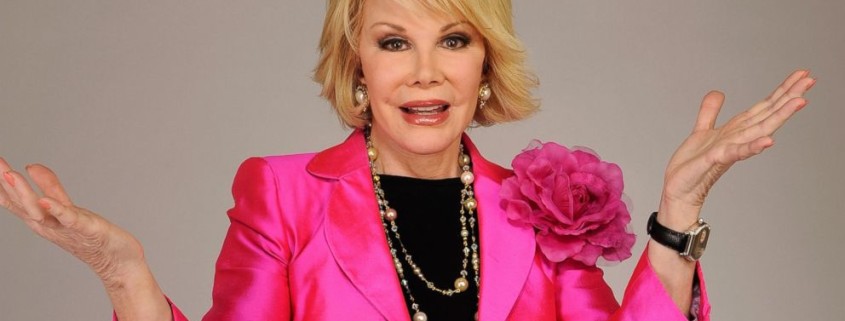

3 Lessons from Joan Rivers in Estate Planning and Pet Trusts

You generally don’t hear about celebrity estate plans unless something goes wrong. But Joan Rivers’ estate planning, which included gifts to her dogs, serves as a great example of the proper way to plan an estate. Ms. Rivers’ arrangement did a lot of things right and the highlights below can be used by almost anybody.

Lesson 1: Hold Assets in a Family Trust

A large portion of Ms. Rivers’ assets were held in a family trust. Doing this may allow for a number of benefits including:

- Privacy: The specifics of trust arrangement are subject to less review by the public, as well as other trust beneficiaries. This can be a benefit if the trust creator does not necessarily want all beneficiaries to have knowledge of all terms of the trust.

- Additional discretion regarding distribution: The trust may specify exactly how and when assets are distributed

- Tax benefits: Trust may be structured to decrease the trust creator’s tax liability.

Lesson 2: Use Pet Trusts as Applicable

Ms. Rivers, being a comedienne, had a set of jokes that related to her dogs. Like many of us, she wanted to ensure her pets were cared for in the event of her passing. The use of pet trustd can be great instruments to ensure that pets are properly cared for. Pet trusts can specify preferred guardians for pets, set aside funds to be held by the caretaker or a third party for care of the pet, and help to ensure the pet is cared for in the manner their previous owner has determined to be appropriate.

Lesson 3: Don’t Make a “Verbal Will”

According to certain sources, Ms. Rivers made it well known that she intended to leave most of her assets to her daughter, Melissa. But the law generally does not allow for assets to be distributed according to what a person may have said to their lifetime, even if “everybody knew.” Most often, a legally effective will is required. Fortunately, Ms. Rivers took the correct steps to make her wishes enforceable in court.

By working with legal counsel to accurately and effectively make her final wishes legally effective, Ms. Rivers took the right steps to ensure that her loved ones were properly cared for when she was no longer here to do so.